In financial transactions, credit notes and debit notes hold distinct roles that can often lead to confusion. These two documents serve as essential tools for businesses to record adjustments and corrections in their accounting records accurately.

This blog will delve into the details of credit notes and debit notes and discuss their key differences, shedding light on their respective purposes and how they impact financial statements. By gaining a clear understanding of these documents, individuals and businesses can navigate their financial documentation with greater clarity and precision.

So, without further ado, let’s dive into the topic.

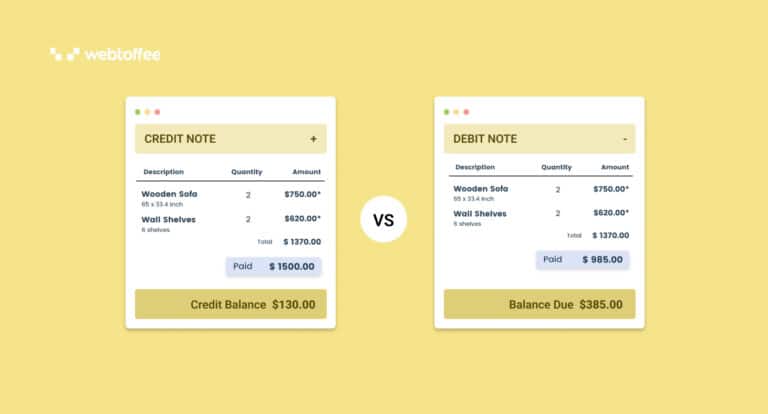

Let’s first understand the key difference between credit notes and debit notes:

| CREDIT NOTES | DEBIT NOTES |

| A credit note is sent by the seller to the buyer | A debit note is sent by the buyer to the seller. |

| Serves as proof that money is being repaid to the buyer, indicating a refund or adjustment in the amount owed. | Acts as proof of a request for repayment from the buyer’s side, signaling a refund or adjustment. |

| Reflects a negative amount | Reflects a positive amount |

| The sales return book is updated | The purchase return book is updated |

| A kind of sales return | A kind of purchase return |

Now, let’s dig deep into each of these financial terms.

A debit note is a document from a buyer to a seller that tells a business they need to give money back (credit owed) and asks for it to be paid back. It’s like asking for a refund. Buyers send these notes to sellers when they want to return something they bought. They’re kind of like invoices but for the purpose of refunds.

Debit notes show the amount of money that needs to be given back and also give extra information about the items bought, the dates, and why the note was made.

A debit note works by notifying the seller that they need to pay back money to the buyer. A debit note is initiated when a buyer realizes that they have paid more money than they should have, need to return goods, or need to get a refund for some reason.

When a seller gets a debit note, they will need to review it, understand the reasons for the increase, and then make the additional payment as instructed in the note.

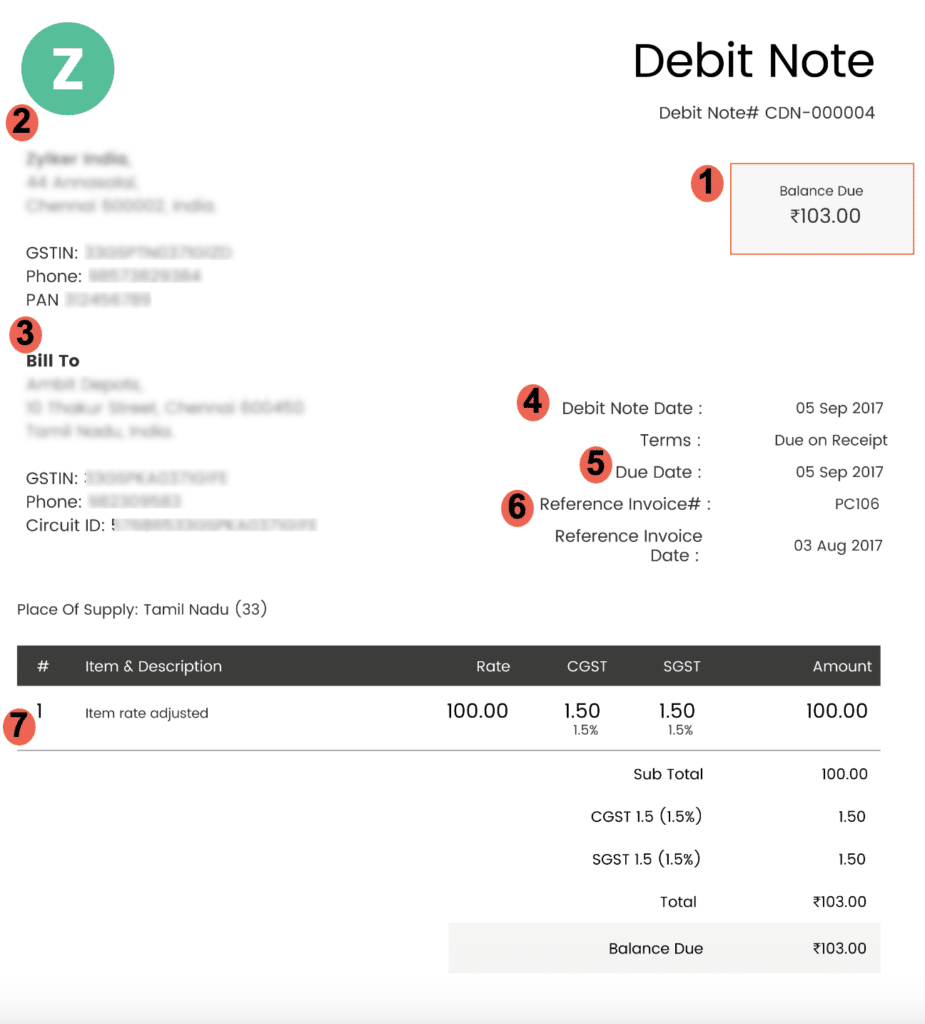

A debit note includes the following elements:

- Balance Due: The due amount or the additional amount that needs to be paid.

- Sender’s Information: This includes the name, address, and contact details of the company or individual issuing the debit note.

- Recipient’s Information: This includes the name, address, and contact details of the recipient who needs to pay the additional amount.

- Date: The date when the debit note is issued.

- Due Date: The deadline by which the recipient needs to make the payment for the additional charges mentioned in the debit note.

- Reference Details: Information about the original invoice, such as the invoice number and date, to which the debit note is related.

- Description of items: A breakdown of the charges being added, including item names, quantities, prices, and any applicable taxes. A clear explanation of why the additional charges are being applied can also be added. This could include errors, additional items, price adjustments, or other relevant reasons.

A credit note is a document used in accounting to show a reduction in the amount owed by a company or individual. It’s usually provided by a seller or service provider to inform the recipient that they owe less money than originally stated.

Credit notes are often issued to fix mistakes, acknowledge returns, or adjust for discounts or refunds. In simple terms, a credit note means that the recipient owes less money to the seller than the amount initially recorded.

A credit note works by telling customers they have received a credit or reduction in the amount they owe. It’s like a “money back” note. It’s given by a seller after they’ve already sent an invoice to show that the customer’s bill has been lowered. It’s like a way to fix things if there’s been a mistake or if the customer needs a refund.

When someone receives a credit note, they should review it, understand why the amount is reduced, and adjust their payment accordingly. It helps keep track of accurate payments and balances.

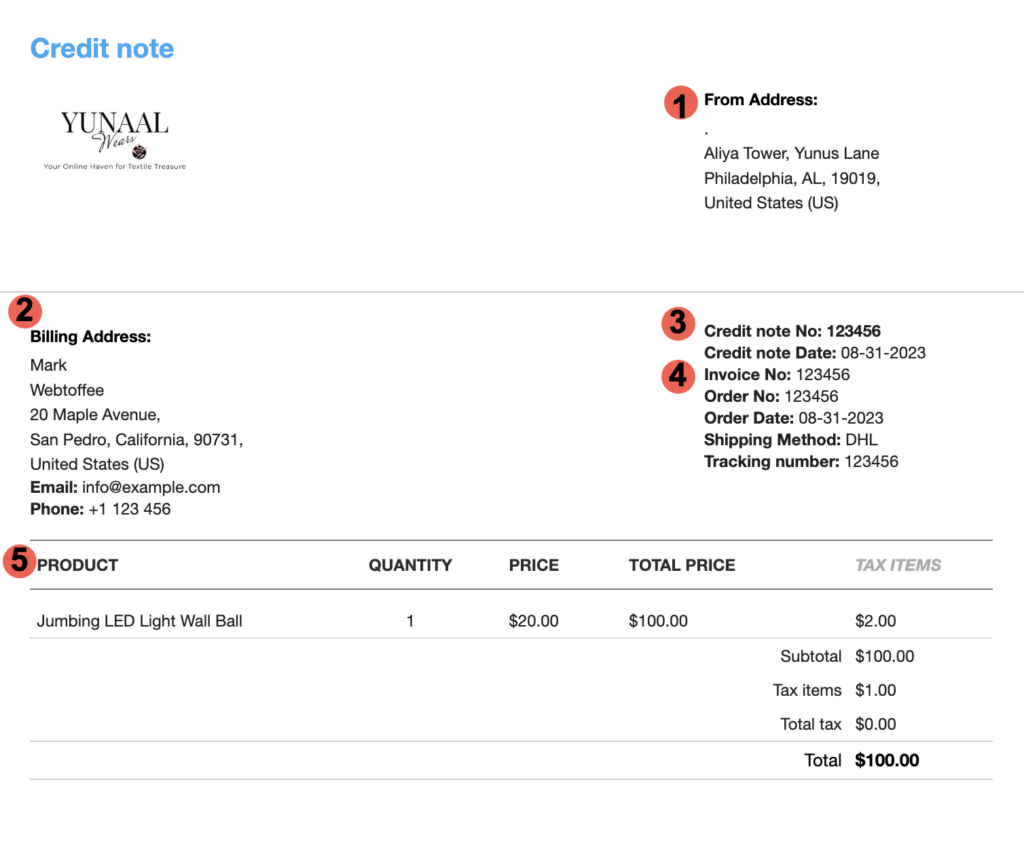

A credit note includes the following elements:

- Issuer’s Information: This includes the name, address, and contact details of the company or individual issuing the credit note.

- Recipient’s Information: This includes the name, address, and contact details of the recipient who is receiving the credit.

- Credit Note Number and Credit Date: A unique identification number for tracking and reference purposes and the date when the credit note is issued.

- Reference Details: Information about the original invoice, such as the invoice number, order number, and order date, to which the credit note is related.

- Description of Credit: A breakdown of the credit being applied, including item names, quantities, prices, and any applicable adjustments.

Conclusion

The distinction between credit notes and debit notes emerges as a fundamental aspect of accurate accounting. While credit notes signify reductions in owed amounts, debit notes highlight requests for repayment. These concise documents play a major role in rectifying errors, facilitating returns, and ensuring the integrity of financial records.

Understanding the unique functions of credit notes and debit notes empowers businesses and individuals to navigate financial transactions with precision and clarity, fostering effective communication and equitable resolutions in the realm of commerce.