A credit note is a document issued by a seller or business to acknowledge and rectify a financial transaction. It serves as a way to give credit to a buyer for a certain amount, typically due to reasons like returned goods, overpayment, or a discount.

For instance, if you purchase a product and later decide to return it due to a defect, the seller might issue you a credit note for the value of the product. This credit note can then be used as a form of payment for your future purchases from the same seller, effectively reducing the amount you owe.

In essence, a credit note acts as a financial tool to maintain transparency and fairness in business transactions. It not only helps businesses manage their accounts accurately but also strengthens customer relationships by demonstrating a commitment to resolving issues and providing value in a structured manner.

Whether it’s correcting errors, accommodating customer requests, or facilitating refunds, credit notes play a crucial role in ensuring that financial dealings remain balanced and trustworthy for all parties involved. Still confused?! This blog post is going to further discuss the importance, purpose, benefits, and components of a credit note.

Let’s take a look!

The purpose of credit notes is to formally document and communicate adjustments to financial transactions between a buyer and a seller. They serve several key purposes:

Correction of Errors: Credit notes are used to rectify mistakes in invoices, such as incorrect prices, quantities, or discounts. They ensure that both parties have an accurate record of the transaction.

Returns and Refunds: When a customer returns goods or services due to defects, dissatisfaction, or other reasons, a credit note is issued to reflect the reduction in the amount owed. This helps maintain transparency in the accounting process.

Overpayments: If a customer pays more than the actual amount due, a credit note is issued to acknowledge the excess payment and adjust the accounts accordingly.

Discounts and Adjustments: In cases where a seller agrees to provide a discount after the initial invoice has been issued, a credit note is issued to reduce the amount payable by the buyer.

Subscription Adjustments: When customers change or cancel their subscription plans before the billing cycle completes, credit notes are used to modify the upcoming invoice amount to match the revised plan.

Account Reconciliation: Credit notes assist in reconciling accounts between buyers and sellers. They ensure that both parties have matching records of transactions, helping to avoid confusion and disputes.

Legal and Regulatory Compliance: Credit notes play a role in adhering to financial and tax regulations. They provide evidence of changes in financial obligations and can be important for auditing and reporting purposes.

Overall, credit notes facilitate accurate and transparent financial transactions between parties by documenting changes to invoices and ensuring that both sides have a clear understanding of the adjustments made.

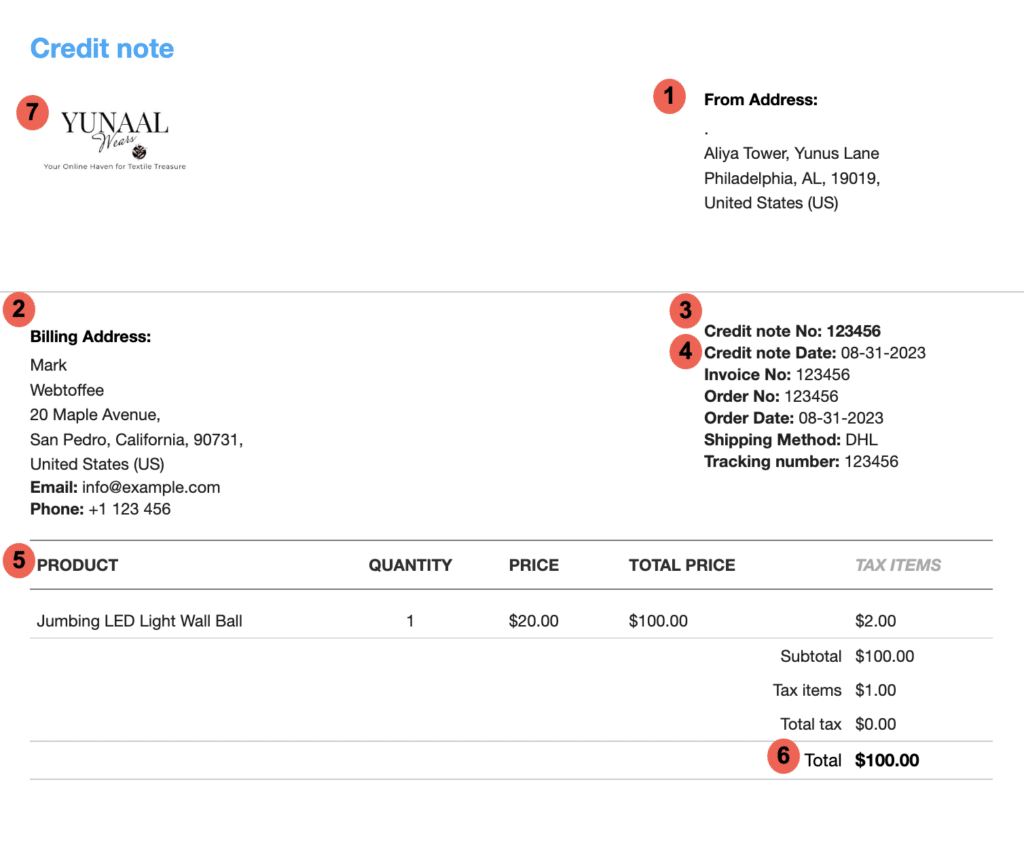

A credit note typically includes several key components to ensure clear communication and accurate record-keeping. These components are:

- Sender: The name and contact information of the entity issuing the credit note (seller/vendor)

- Recipient: The name and contact information of the entity receiving the credit note (buyer/customer)

- Credit Note Number: A unique identifier assigned to the credit note for reference and tracking purposes

- Date: The date when the credit note is issued

- Details: Specific information about the items or services being adjusted, including product names, quantities, unit prices, and any applicable taxes

- Credit Amount: The total amount being credited to the buyer’s account, including any applicable taxes and deductions

- Company Logo: The logo of the company issuing the credit note, which adds professionalism to the document

Credit notes offer several benefits for both buyers and sellers in commercial transactions:

Accuracy and Transparency: Credit notes help rectify errors, discrepancies, or changes in transactions. They provide a clear and documented account of why an adjustment is being made, enhancing transparency and accuracy in financial records.

Customer Satisfaction: Issuing credit notes for returned or faulty items can enhance customer satisfaction and loyalty by showing a commitment to resolving issues and facilitating hassle-free returns.

Improved Relationships: Issuing credit notes in a timely and accurate manner demonstrates professionalism and a commitment to fair business practices, strengthening relationships between buyers and sellers.

Operational Efficiency: Credit notes streamline the process of making adjustments to transactions, reducing administrative complexity and potential errors.

Auditing and Reporting: Credit notes contribute to comprehensive financial documentation that can be useful during audits, regulatory inspections, or internal reviews.

Legal Protection: Credit notes serve as legal documents that help protect the rights and obligations of both parties. They offer evidence of the agreed-upon adjustments to transactions.

Actually, a credit note is not exactly like a refund. When you get a refund, you get your money back right away.

A credit note is more like saying, “Hey, you don’t have to pay this much.” It’s like a note that shows how much the seller owes you. You can use this note to lower your next payment or use it for future payments. Or, if you’ve already paid everything, you might ask for the money instead. So, they’re kind of similar but not quite the same.

There is no fixed deadline to give out a credit note. You can issue it whenever you need to. But you have to mention it in the GST returns you file for that month.

If the credit note relates to a specific financial year, there’s a rule. You should declare it in your GST returns either by the 30th of September of the next year or when you file the annual return for that time. So, while there’s no strict time limit, you should still report it in your returns within those deadlines.

Key Takeaway

Understanding credit notes and how to use them is useful for both buyers and sellers. These documents are important for rectifying errors, facilitating returns, and maintaining transparent financial transactions.

Whether you’re a business issuing credit notes to adjust invoices or a customer receiving them, knowing their purpose and the steps involved can help you navigate financial adjustments with confidence. By grasping the concept of credit notes, you’re better equipped to ensure accurate records and comply with legal and regulatory requirements.