When it comes to business transactions, there’s a lot of paperwork involved, like invoices and bills. But have you ever heard of something called a “proforma invoice”?

So, what exactly is a proforma invoice? Think of it as a “preview” or “first draft” of an invoice. When a business is about to make a sale, it often needs to agree with the buyer on factors like the price, delivery date, and what’s included. Before finalizing everything, they send a proforma invoice to the buyer. This document outlines all the important details, like what the buyer will get, how much it costs, and when it will be delivered.

Let’s dive deeper into the term “proforma invoices” and explore why they’re used, when they come into play, and how they differ from regular invoices. So, if you’re ready to uncover the ins and outs of these preliminary invoices, let’s get started!

A proforma invoice is a preliminary or “draft” invoice sent by a seller to a buyer before a sale is confirmed. It is a formal document that outlines the details of a potential transaction, including the goods or services to be provided, their respective prices, any applicable discounts, shipping information, and the expected delivery date.

This document is not the final invoice but rather a way for the seller to communicate to the buyer what they can expect if the sale proceeds as discussed. It allows both parties to review the terms of the deal and make any necessary adjustments or negotiations before finalizing the transaction. Once the buyer approves the proforma invoice, the seller can issue the official sales invoice and proceed with the sale.

The purpose of a proforma invoice is multifaceted and serves several important functions in business transactions:

Communication of transaction details: A proforma invoice is a tool for communicating to the buyer the specifics of a potential transaction. It outlines what goods or services will be provided, their prices, quantities, and any applicable discounts. This clarity helps both parties understand the terms of the deal.

Invitation for negotiation: Proforma invoices invite negotiation between the buyer and seller. They provide an opportunity for the buyer to review the terms and, if necessary, request changes or negotiate pricing and other terms before the sale is finalized.

Demonstration of willingness: By issuing a proforma invoice, the seller demonstrates their willingness and commitment to fulfilling the agreed-upon terms and conditions of the sale, reinforcing trust in the business relationship.

Internal documentation: Proforma invoices can be used for internal purposes within the buyer’s organization. They may serve as documentation for purchase approval protocols or financial planning.

Streamlining the quote-to-cash process: Proforma invoices help streamline the entire sales process. They enable the seller to present a formal proposal quickly, giving the buyer an early understanding of the transaction’s details and reducing the time it takes to finalize the sale.

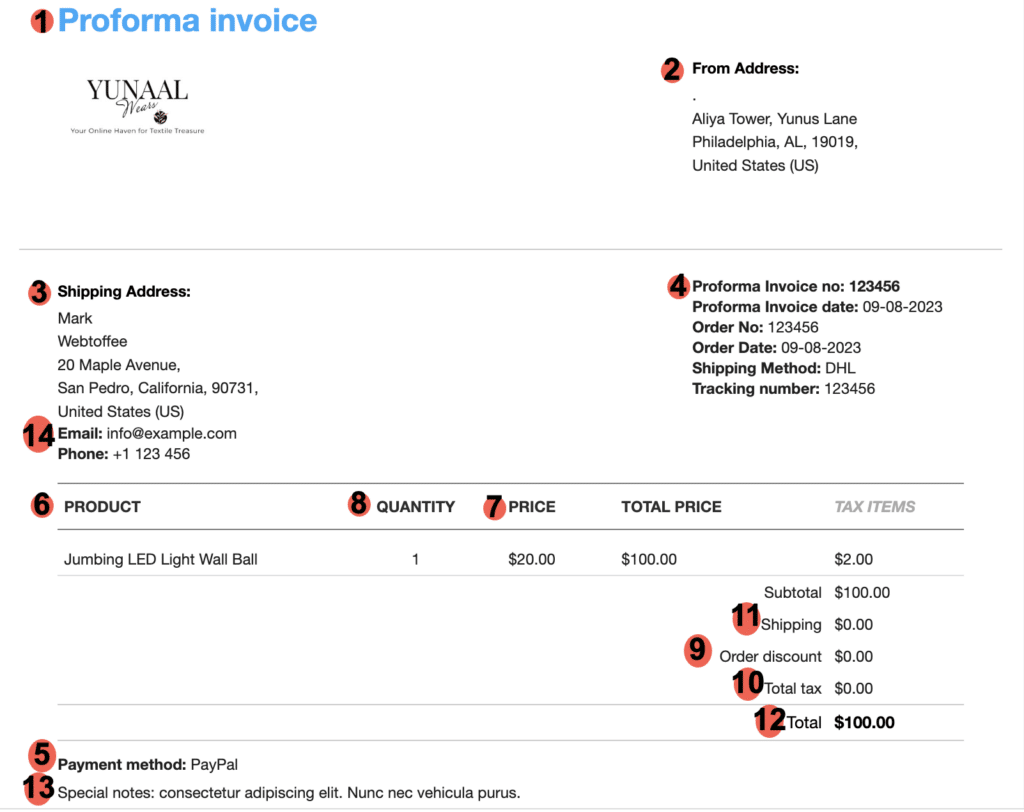

A proforma invoice typically includes the following elements:

- Document title: It is labeled as “Proforma Invoice” to distinguish it from other types of invoices.

- Seller’s information: This includes the name and address of the seller.

- Buyer’s information: This includes the name and address of the buyer.

- Invoice date: The date when the proforma invoice is issued.

- Payment terms: The agreed-upon terms for payment and the preferred payment method.

- Description of goods or services: A detailed list of the items or services to be provided.

- Prices: The unit prices of the goods or services, often listed next to each item.

- Quantity: The quantity or number of units for each item or service.

- Discounts: Any discounts or price reductions applied to the invoice, including any terms or conditions associated with the discounts.

- Taxes: Information about applicable taxes, such as sales tax or value-added tax (VAT), including tax rates and the total tax amount.

- Shipping information: Details about the shipping costs.

- Total amount: The sum of all individual line item totals, including taxes and any additional charges.

- Additional notes: Any additional information or special instructions relevant to the transaction. Any specific terms and conditions related to the sale, such as warranties, return policies, or other contractual obligations, can also be added.

- Contact information: Contact details of the buyer, including phone numbers and email addresses.

It’s important to note that while these elements are commonly found in proforma invoices, the specific format and details may vary depending on the business’s needs and industry practices. Customization is common to ensure that the proforma invoice accurately reflects the terms of the particular transaction.

A proforma invoice is typically issued at the preliminary stages of a potential sale before the sale is confirmed and finalized. It serves as a proactive step in the sales process when a seller and buyer have engaged in discussions about a potential transaction but haven’t yet reached a definitive agreement on terms, prices, or other crucial details.

By providing a proforma invoice early on, the seller offers a clear proposal of what’s being offered, setting the stage for negotiation and agreement before the sale progresses.

No, a proforma invoice is not a legal document. Unlike a formal invoice, a proforma invoice does not demand payment, and it is not legally binding. It serves as a tool to facilitate communication, negotiation, and clarity between the buyer and seller.

It outlines the expected goods or services, their prices, and other relevant details, but it does not have the legal status of an invoice, which is a document used to request payment for completed goods or services formally.

| INVOICE | PROFORMA INVOICE |

| Issued after a sale is finalized | Issued before the sale is finalized |

| A legally binding document | Not a legally binding document |

| Requests payment from the buyer | Does not request payment; instead, it provides information about what the buyer can expect if the sale proceeds |

| Not used for negotiation | Often used in negotiation |

| The primary purpose is to request payment and provide a record of the completed transaction | The primary purpose is to provide a preview of the transaction’s terms, facilitate negotiation, and establish clarity between buyer and seller |

Yes, a proforma invoice can be canceled, as it is a preliminary document and not a formal demand for payment. The process for canceling a proforma invoice is typically straightforward and depends on the agreement between the buyer and seller.

Conclusion

Proforma invoices offer a clear and flexible way to outline potential transactions before they are finalized. These preliminary documents facilitate communication, invite negotiation, and help build trust between buyers and sellers.

While they are not legally binding, proforma invoices streamline the sales process and ensure that everyone is on the same page before the final invoice is issued. So, whether you’re a buyer looking for transparency or a seller seeking to strengthen client relationships, understanding and using proforma invoices can be a valuable tool in your business toolkit.