As businesses increasingly prefer online platforms, the significance of eCommerce payment processing cannot be ignored. Analysts predict that by the end of 2024, total eCommerce sales are anticipated to reach $8.1 trillion. The ease and reliability with which financial transactions are conducted directly impact customer trust, satisfaction, and, ultimately, the success of an online venture.

This blog will delve into eCommerce payment processing and its fundamental aspects. Whether you’re an entrepreneur venturing into the online marketplace or a consumer looking to understand the backbone of secure online shopping, this blog aims to be your comprehensive guide to eCommerce payment processing.

The key components of eCommerce payment processing encompass a range of elements that work together to facilitate secure and efficient transactions. These components typically include:

Payment Gateway

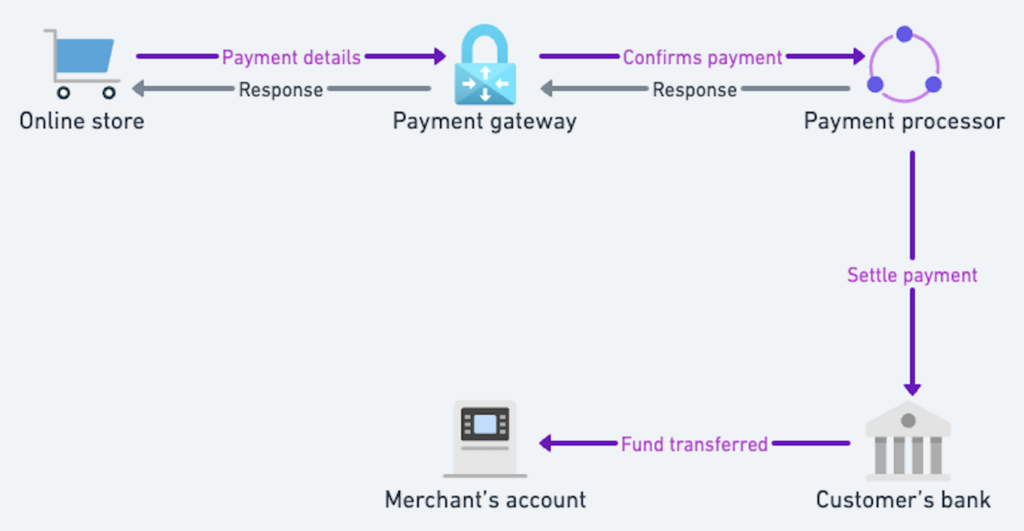

A payment gateway serves as a crucial intermediary in the process of eCommerce payment processing, managing secure transactions between online merchants and their customers. Essentially, it acts as a bridge, connecting the merchant’s website or application and the financial institution that manages payments.

Several payment gateway providers dominate the eCommerce landscape, offering a range of services that fulfill the needs of businesses of all sizes. Some of the most prominent payment gateway providers include Stripe, PayPal, Authorize.Net, and more. These payment gateway providers, among others, play a vital role in enabling merchants to accept payments securely and efficiently.

Merchant Account

A merchant account is a specialized bank account that enables businesses to accept and process online payments. It is necessary because it serves as an intermediary where funds from customer transactions are temporarily held before being transferred to the main business account.

The payment gateway securely transfers payment information from customers to the merchant account. Once the transaction is verified, the funds are held in the merchant account before being deposited into the business’s primary bank account. This process ensures a smooth and secure flow of funds during online transactions.

Payment Processor

Payment processors are third-party services that manage the actual transaction process. While the payment gateway securely transfers payment information, the payment processor takes on the responsibility of approving or declining transactions.

Payment processors work closely with banks. When a customer initiates a purchase, the payment processor communicates with the payment gateway to verify and approve the transaction. It then interacts with the customer’s issuing bank to ensure sufficient funds and transaction accuracy. Once approved, the payment processor facilitates the transfer of funds from the customer to the merchant, completing the transaction in real time.

Fraud Prevention Tools

To mitigate the risks associated with online transactions, eCommerce payment processing incorporates advanced fraud prevention tools. These tools analyze transaction patterns, detect anomalies, and employ security measures such as two-factor authentication to safeguard against fraudulent activities.

Ecommerce has given rise to a diverse array of payment methods, providing consumers with flexibility and convenience. Businesses today accommodate various preferences by supporting multiple payment options. Here are some common types of payment methods:

Credit and Debit Cards: In credit cards, customers can make purchases using a line of credit with the option to pay the balance over time, and in debit cards, transactions are directly linked to the customer’s bank account, deducting the purchase amount instantly.

Digital Wallets: Popular examples include PayPal, Apple Pay, Google Pay, and Samsung Pay. Users link their credit/debit cards or bank accounts to the digital wallet for secure and quick transactions.

Bank Transfers: Customers initiate payments directly from their bank accounts to the merchant’s account. This method is often used for large transactions or in regions where card usage is limited.

Cryptocurrencies: Cryptocurrencies are gaining acceptance as a form of payment on some eCommerce platforms.

Cash on Delivery (COD): In this method, customers pay for goods or services when they are delivered. This is common in regions where online payment adoption is still growing or for high-value items.

Prepaid Cards: These are cards with a predetermined amount loaded onto them. It is used similarly to credit/debit cards but with a fixed spending limit.

Buy Now, Pay Later (BNPL) Services: Services like Afterpay and Klarna allow users to make purchases and pay in installments over time. This option is now gaining popularity for its flexibility.

The user experience during the payment process is a major factor that can significantly influence the success and reputation of an eCommerce platform. A seamless and user-friendly payment process is essential for customer satisfaction and can have a profound impact on the overall success of an online business.

A smooth checkout process should include the following:

Mobile Optimization: As mobile transactions become increasingly prevalent, optimizing the payment process for mobile users is crucial. A responsive and user-friendly mobile checkout experience ensures that customers can seamlessly make purchases from their smartphones or tablets.

Clear and Transparent Information: Providing clear and transparent information about the total cost, including taxes and shipping fees, during the checkout process builds trust with customers. Ambiguity in pricing can lead to frustration and reduce trust, potentially causing users to abandon their carts.

Security and Trust: A secure payment process is paramount for user trust. Implementing SSL certificates, using reputable payment gateways, and incorporating secure authentication methods all contribute to a sense of security for users, enhancing their confidence in making online transactions.

Flexible Payment Options: Offering a variety of payment options accommodates different user preferences. Whether it’s credit/debit cards, digital wallets, or alternative payment methods, providing flexibility enhances user satisfaction by allowing customers to choose the method most convenient for them.

Efficient Error Handling: When errors occur during the payment process, providing clear and actionable error messages helps users understand and resolve issues quickly. Effective error handling prevents frustration and maintains a positive user experience.

Post-Purchase Communication: Communicating order confirmation, tracking details, and delivery information promptly after a successful transaction contributes to a positive post-purchase experience. Keeping users informed builds confidence in the reliability of the eCommerce platform.

Expanding into the global market requires careful consideration of various factors in eCommerce payment processing. Successfully navigating the complexities of cross-border transactions is crucial for businesses aiming to reach a diverse international customer base.

Here are key considerations and factors that support effective cross-border eCommerce payment processing:

Currency Conversion: Offering multi-currency support allows customers to view and pay for products in their local currencies, minimizing confusion and conversion-related issues. Transparent and up-to-date exchange rates during the checkout process contribute to a positive user experience.

Local Payment Methods: Adapting to local preferences by incorporating region-specific payment methods enhances accessibility for customers. For example, accepting Alipay in China or iDEAL in the Netherlands caters to local preferences. Recognizing the prominence of digital wallets, credit cards, and other preferred payment methods in different regions is essential.

Compliance with Regional Regulations: Adhering to the specific regulations of each country or region is crucial. This includes data protection laws, tax regulations, and compliance with financial and consumer protection regulations.

Cross-Border Shipping and Taxation: Integrating shipping and taxation information that aligns with international standards is essential. Simplifying international shipping options and providing accurate delivery estimates contribute to customer satisfaction.

Customer Support and Communication: Providing multilingual customer support and communication channels helps address the diverse needs of an international customer base.

In eCommerce payment processing, regulatory compliance is essential to ensure security, transparency, and fair practices within the digital financial ecosystem. Several key regulatory requirements govern this space, aiming to protect both consumers and businesses engaged in online transactions:

Payment Card Industry Data Security Standard (PCI DSS)

The PCI DSS sets forth a comprehensive framework for securing credit and debit card transactions. Compliance with PCI DSS is mandatory for businesses that handle payment card information. It includes measures such as encryption, regular security assessments, and strict access controls to safeguard sensitive financial data.

Anti-Money Laundering (AML) and Know Your Customer (KYC) Regulations

AML regulations require businesses to implement measures to detect and prevent money laundering activities. KYC regulations mandate the verification of customer identities to mitigate fraud and ensure the legitimacy of transactions. Compliance with these regulations is crucial for eCommerce platforms to maintain a secure and transparent financial environment.

Consumer Data Protection Laws

Various data protection laws, such as the General Data Protection Regulation (GDPR) in the European Union and the California Consumer Privacy Act (CCPA) in the United States, govern the collection, processing, and storage of personal information. eCommerce businesses must adhere to these laws to protect customer privacy and avoid legal consequences.

International Regulations

For businesses operating globally, compliance with international regulations and standards is crucial. Understanding and adhering to the financial regulations of specific countries and regions ensures smooth cross-border transactions and helps avoid legal complications.

Accessibility Standards

Compliance with accessibility standards, such as the Web Content Accessibility Guidelines (WCAG), ensures that eCommerce websites are accessible to individuals with disabilities. This inclusivity is not only a legal requirement in some jurisdictions but also contributes to a positive user experience.

Adhering to these regulatory requirements is not only a legal obligation for eCommerce businesses but also a means of building trust among customers. Staying informed about evolving regulations and proactively implementing compliance measures is crucial for the sustained success and integrity of eCommerce payment processing.

Conclusion

eCommerce payment processing serves as the backbone of online transactions, ensuring seamless and secure exchanges between buyers and sellers in the digital marketplace. Throughout this blog, we’ve explored the essential components of eCommerce payment processing, from payment gateways and merchant accounts to the diverse array of payment methods available.

It’s evident that providing a smooth and user-friendly payment experience is paramount for enhancing customer satisfaction and driving business success. However, it’s important to recognize that eCommerce payment processing is a dynamic and evolving field, with new technologies and regulations constantly shaping.

Therefore, businesses must stay informed and adapt to emerging trends to remain competitive and deliver exceptional payment experiences to their customers. By prioritizing security, flexibility, and user experience, businesses can navigate the complexities of eCommerce payment processing with confidence and ensure sustained success in the ever-changing digital economy.