In online business, a reliable payment gateway is foundational for a seamless customer experience. A great payment gateway makes online transactions simple, ensuring that the buying process is smooth and secure. One such payment option with practical features is Stripe. This blog takes a closer look at specific features offered by Stripe, focusing on their functionality and how they can benefit your eCommerce store.

By delving into Stripe’s features, this blog aims to help you make an informed decision about whether the platform aligns with your eCommerce needs.

Stripe is an online payment processing platform founded in 2010. It enables businesses to accept and manage online payments securely.

It was initially designed for small businesses, but it evolved into a versatile platform for enterprises. Known for its user-friendly interface, developer-friendly approach, and global adaptability, Stripe is a popular choice for businesses of all sizes. Its reliability and continuous innovation have solidified its position as a go-to solution in the eCommerce landscape.

Significant Features of Stripe

From seamless payment processing and robust security measures to advanced analytics and customizable checkout experiences, Stripe offers a comprehensive suite of features designed to supercharge your store’s performance and enhance the overall customer experience.

Let’s dive into the key features of Stripe.

Seamless Integration

Integrating Stripe into your eCommerce platform is a straightforward process. If you’re already using tools for customer management, quotes, inventory, shipping, or accounting, Stripe offers pre-built integrations to connect with them seamlessly. This ensures a smooth transition without disrupting your existing workflow.

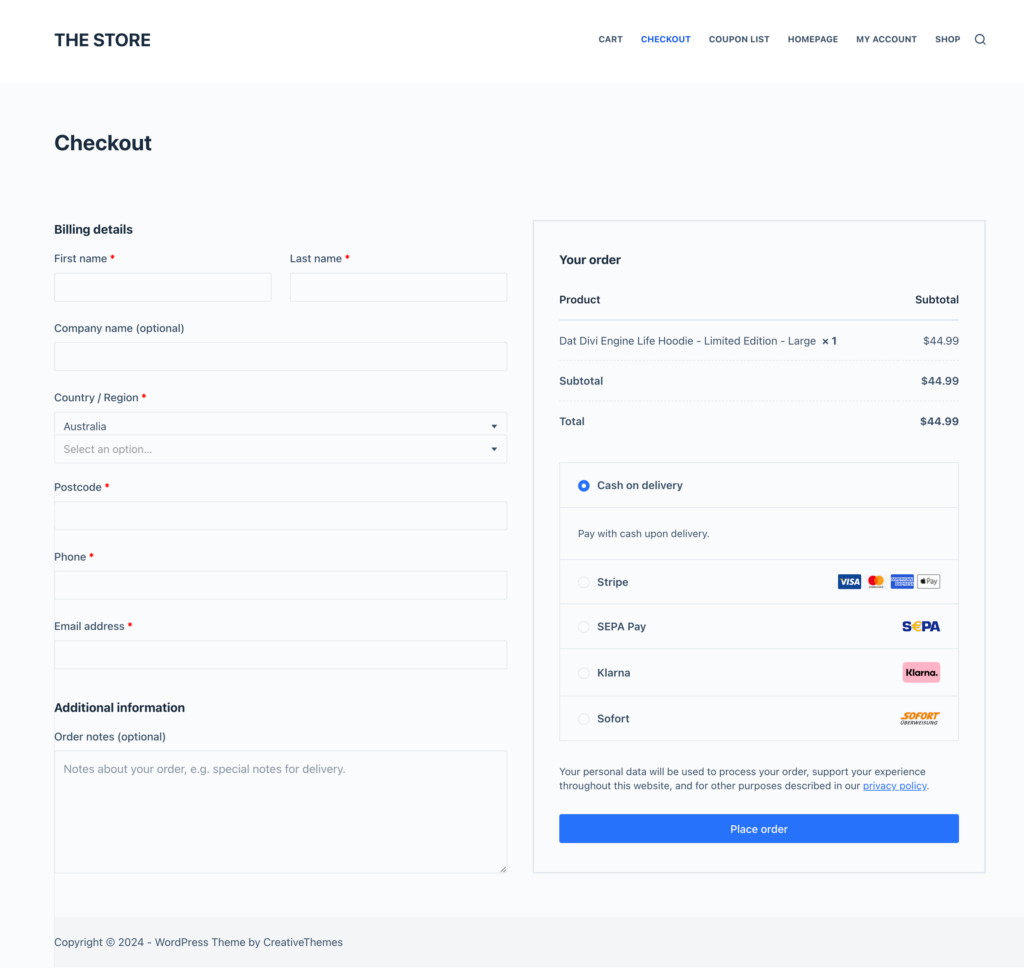

Additionally, Stripe has partnered with numerous popular eCommerce platforms, providing plugins that facilitate quick and efficient integration. Whether your store operates on Shopify, WooCommerce, or other leading platforms, Stripe’s compatibility ensures a hassle-free setup.

Payment Options

Stripe’s payment method is designed to help your business expand globally and enhance checkout conversion by accommodating a diverse range of payment options. These are categorized into eight types:

Cards: Stripe supports global and local card networks.

Bank Debits: Stripe directly debits the customer’s bank account with permission.

Bank Redirects: This enables online payments using bank accounts through a secure checkout. This option is popular among non-US consumers, enhancing conversion and reducing fraud.

Bank Transfers: Allows customers or businesses to send money directly to your bank account. This is common for large payments from other businesses and, in some countries, for consumer payments.

Buy Now, Pay Later: This method facilitates payments in installments, reaching a broader customer base. Here, your business is paid immediately, while customers pay later or in portions at checkout.

Real-time Payments: Here, customers send money directly from their bank account using an intermediary for authentication. This is common in Asia and Latin America.

Vouchers: Here, customers receive digital vouchers at checkout and complete payments at local stores. This method is also popular in Asia and Latin America.

Wallets: This is a fast and secure payment option using saved cards or stored balances that improves conversion and reduces fraud, especially on mobile.

Simplified Checkout Experience

Stripe’s checkout flow is optimized, ensuring a seamless and user-friendly experience for your customers. The platform provides a pre-built payment form that minimizes friction during the checkout process. This not only reduces the steps customers need to take but also supports a variety of relevant global payment methods.

Stripe is adaptable to your customer’s language and device. Moreover, for businesses looking to create a fully customized experience, Stripe offers flexible integration options. This not only allows you to create the checkout flow to match your brand but also simplifies PCI compliance, ensuring a secure transaction environment.

Whether your customers prefer using traditional credit cards, digital wallets like Apple Pay and Google Pay, or regional options such as Alipay and WeChat Pay, Stripe includes a diverse range of preferences. Stripe supports payment methods, including Apple Pay, Google Pay, Alipay, WeChat Pay, Afterpay, ACH Credit Transfer, ACH Debit, SEPA Direct Debit, Bacs Direct Debit, BECS Direct Debit, iDEAL, Bancontact, Giropay, Przelewy24, FPX, EPS, and OXXO.

Churn Management

Stripe’s payment method is not just about processing transactions; it’s a dynamic system that maximizes acceptance of networks and prevents involuntary churn.

Stripe optimizes payment authorization across a vast network of tens of thousands of issuers globally. This ensures that payments are authorized efficiently, increasing the likelihood of successful transactions.

If a payment is declined, Stripe identifies the best retry messaging and routing combinations. This approach is designed to minimize the chances of revenue loss due to payment issues.

Stripe maximizes acceptance and prevents involuntary churn through:

- Smart assignment of Merchant IDs (MID) and Merchant Category Codes (MCC)

- Direct integration to major card networks for smooth transactions

- Automatic optimization for International Organization for Standardization (ISO) compliance

- Automated retries for payment processing

- A system that automatically updates card account information for smooth transactions

Fraud Prevention

Stripe’s fraud prevention is powerful and built into every account, offering effective tools like Radar to detect and prevent fraudulent activities. Stripe Radar is an integral feature that automatically assesses every transaction using machine learning models and reduces 32% of fraudulent activities on average.

Key features within Stripe’s fraud prevention include:

- Utilizes advanced techniques like device fingerprinting to identify potential fraud

- Detects proxy usage to enhance security measures

- Allows businesses to set up custom rules to control which transactions are accepted or rejected

- Enhances security with dynamic 3D Secure technology

- Submits transaction review queues for manual examination whenever needed

- Provides businesses with advanced insights into potential fraud patterns

Subscription Management

Stripe’s subscription management, powered by Stripe Billing, simplifies the process of handling memberships and subscriptions with its array of features.

Stripe Billing simplifies subscription management by offering intuitive tools for setting up, managing, and automating recurring plans and invoices, making it a seamless experience for businesses.

- Easily sets up recurring plans for memberships or subscriptions

- Simplifies invoice generation and distribution for hassle-free billing

- Adapts billing according to your business needs, from simple recurring billing to more complex models like usage-based billing and negotiated contracts

- Offers automation features to simplify revenue management tasks

- Accepts payments globally and ensures a seamless payment experience for international subscribers

Stripe Terminal

Stripe Terminal is a feature that allows you to extend your Stripe payments to your point of sale, enabling in-person transactions to be effortlessly managed alongside your online business.

It supports payments in your local currency using compatible card brands. Stripe Terminal provides pre-certified readers and Tap to Pay functionality, allowing users to accept in-person contactless payments conveniently through a compatible iPhone or Android device using the Stripe Terminal SDK.

This feature is available in 15+ countries, and for those outside the currently available countries, there’s an option to request an invite to test Terminal.

Developer-Friendly

Stripe is a developer-friendly platform that prioritizes ease of integration and provides powerful resources for developers. Here are some key developer-friendly features:

- Stripe offers APIs and integration tools that simplify the development process.

- Developers can quickly get started with a Stripe integration in their preferred programming language

- Stripe provides Software Development Kits (SDKs) for client, server, and UI integration, which can be used by developers to easily integrate Stripe functionality into their applications

- Developers can set up and manage Stripe directly within their preferred code editor.

- Provides a rich library of developer tutorials in video format that provides in-depth insights into Stripe integration

No-code Option

Stripe offers a no-code option, allowing users to get started quickly without the need for any coding. This feature is designed for simplicity, enabling users to utilize Stripe without writing a single line of code. Users can easily explore which Stripe features align with their business needs and follow straightforward instructions to begin using them.

This no-code option provides a user-friendly entry point, ensuring accessibility for those who may not have a coding background but still want to leverage the capabilities of Stripe for their business.

Conclusion

Integrating Stripe into your eCommerce platform can significantly enhance your online business experience. With its user-friendly features, global reach, powerful security, and diverse payment options, Stripe simplifies transactions, minimizes friction, and maximizes conversions. Whether you’re a small startup or a large enterprise, Stripe’s adaptability and commitment to innovation make it a compelling choice.

Consider the possibilities that Stripe offers for an optimized and efficient eCommerce journey. Whether you’re looking to improve checkout flows, explore subscription models, or embrace in-person payments, Stripe provides the tools and resources to elevate your online business.