In this article, we will be discussing eCommerce mobile payments and how to get started with mobile payments for eCommerce businesses. If you are an eCommerce merchant seeking information on mobile payments, this is the right place.

Mobile payments are increasingly becoming popular due to their convenience and ease of use. As more and more people start using mobile payments, the global mobile payment market is expected to grow at a CAGR of 36.2% till 2030.

With the growth of mobile payments at this rate, it will overtake cash and card payments by 2025. So, that’s a call to get your eCommerce website to accept mobile payments.

That being said, let’s get started.

What are Mobile Payments?

Mobile payments are payments processed using mobile devices such as smartphones, smartwatches, and tablets using payment apps or wallets. It offers a convenient way for users to pay for goods and services. Mobile payments typically involve using digital wallets, mobile apps, or other payment platforms to store payment information and facilitate transactions securely.

What are the Different Types of Mobile Payments?

Following are the four common types of mobile payments:

- Browser Payments

This payment method is commonly used in eCommerce websites, where customers can pay from browsers using their mobile devices. They enter their bank account or card details into the merchant’s checkout page to make payments. These payments are mostly secured with OTP (One-time password) verification. So they may have to enter the OTP they received as an SMS or an email to complete the transaction.

Customers can save their bank account or card details on their browser, so they don’t need to enter them each time they make a purchase.

- App Payments & Digital Wallets

Users can integrate mobile payment apps with their bank accounts to make payments through their smartphones. These apps often have digital wallets, which allow them to load money from their bank account and pay using them.

This can make users feel safer because they don’t have to share their bank account or card information on other websites.

Examples: Google Pay, Apple Pay, and Samsung Pay.

- QR Code Payments

Most mobile payment apps support QR (Quick Response) code payments. Merchants can generate a QR code that contains the payment information. Users can scan the QR code using any mobile payment app and initiate the payment.

QR code payments are mostly used by physical stores to allow customers to pay using their smartphones.

- Mobile Point-of-Sale Payments (mPOS)

An mPOS is a smart device that facilitates wireless payments for merchants. It allows merchants to accept contactless payments from their customers. mPos devices accept a wide range of payment methods, such as card swiping, NFC payments, mobile app payments, QR code payments, etc.

Why Mobile Payments are Important in eCommerce?

If you are still unsure whether you should accept mobile payments for your eCommerce business, let’s give you some good reasons:

- Your Customers Prefer It

Customers prefer mobile payments because it provides a convenient way to pay on the go. They can make payments from their smartphones from anywhere. Mobile payment apps usually offer faster payment options by auto-filling payment information or using short passcodes. This saves your customers from the hassle of entering the payment details.

- Provide Enhanced Security

Mobile payment apps provide enhanced security by using biometric authentication such as Face ID or fingerprint scanner. Also, most mobile payment apps have secure encryption ensuring a safe and secure payment experience for your customers.

When you offer secure payment options such as Apple Pay or Google Pay, your customers are more likely to purchase from your store.

- Save You Some Bucks

Mobile payments are mostly cost-effective when compared to credit card payments. The transaction fee is less or sometimes zero cost. This will save you some money in the long run. Additionally, you don’t need any third-party terminal devices to accept mobile payments.

- Reduce the Friction

Mobile payments reduce friction in your checkout processes. Most mobile payment apps are designed to make the payment faster. Customers can make payments easily with the touch of a button or by entering a short passcode. This reduces the number of clicks and friction on your eCommerce checkout page.

How to Set up Mobile Payments in WooCommerce?

If you have built your eCommerce business website using WooCommerce, follow these steps to set up mobile payments on your store.

Step 1: Install and Activate WebToffee WooCommerce Stripe Plugin

We will be using the Stripe payment service to set up mobile payments in WooCommerce. WooCommerce, by default, does not provide support for Stripe, so you will need to install a third-party payment plugin that provides Stripe integration.

There are many free and paid plugins that offer Stripe integration for WooCommerce, but the WooCommerce Stripe payment plugin by WebToffee offers a simple setup process and works seamlessly.

To install the plugin:

- Log in to your WordPress admin page.

- Go to Plugins > Add New.

- Search for ‘Stripe Payment Plugin for WooCommerce’ by WebToffee.

- Once you’ve found the plugin, click on Install Now and then activate the plugin.

Step 2: Configuring Stripe API Keys

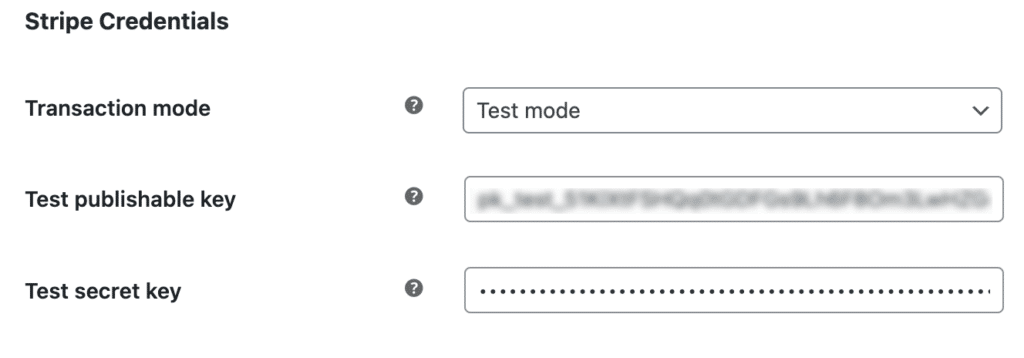

To begin with, you have to create a Stripe account. If you already have one, log in using the credentials and obtain the API keys from the Stripe dashboard.

- Now go to WebToffee Stripe > General Settings from your WordPress admin page.

- Choose a Transaction mode.

- Enter the API keys.

- Click on Save changes.

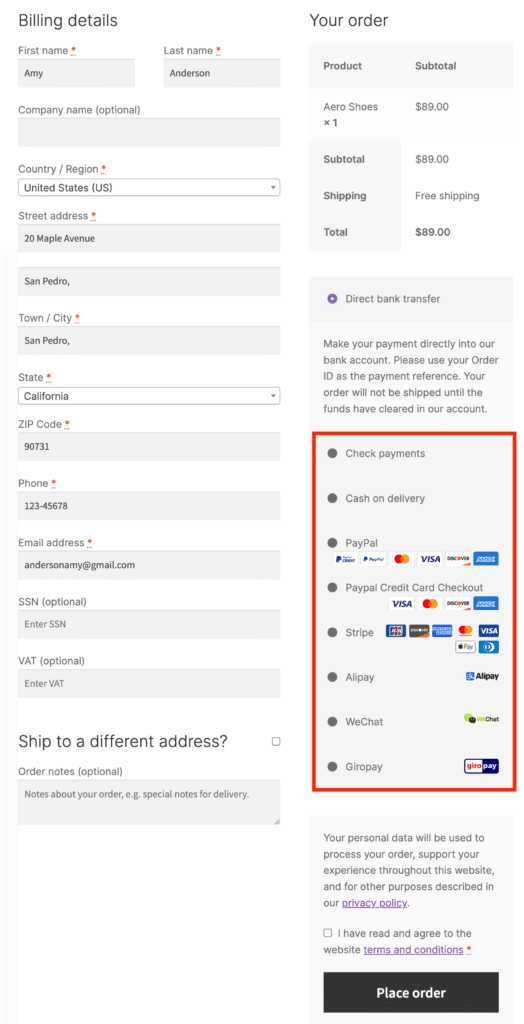

Step 3: Enable the Payment Gateways

You can set up the following mobile payments on your WooCommerce store using this plugin:

- Apple Pay

- Google Pay

- Alipay

- WeChat payments

Choose the right payment gateway for your store and enable it using the plugin.

Also Read:

How to set up Apple Pay in WooCommerce (for free)

How to set up Google Pay in WooCommerce (for free)

Additionally, the plugin lets you set up 20+ local payment gateways on your WooCommerce website.

Frequently Asked Questions

What is NFC?

NFC is a short-range wireless technology that allows devices to establish a connection when they are put together in a close range ( 4cm or less). Modern smartphones are equipped with NFC that allows users to make contactless payments through their mobile devices by simply tapping the device on the payment terminal.

What is Stripe?

Stripe is a popular payment processing platform that offers a set of APIs and tools to help businesses accept and manage online payments. It offers enhanced security features and fraud detection to provide a secure and seamless payment experience.

Stripe supports various payment methods, including credit cards, debit cards, digital wallets like Apple Pay, and Google Pay, and many local payment gateways.

Are Mobile Payment Apps Safe?

Yes. Most mobile payment apps provide enhanced encryption to prevent any fraud and unauthorized access. You can add additional authentication using your device’s Face ID or fingerprint scanner.

However, there are thousands of mobile payment apps available, and we can’t say all of them have such enhanced security features. So it’s always better to rely on popular payment apps like Apple Pay and Google Pay.

What is Two-Factor Authentication (2FA)?

Two-factor authentication is a security system that requires two separate types of identification for accessing a network. This may include password authentication and biometric authentication to allow users to access a system. This type of authentication system is commonly used in payment platforms, social media websites, and banking websites.

Conclusion

With the rising popularity of mobile payments, it is important that you allow your customers to pay using their smartphones on your eCommerce website. If you haven’t already set up mobile payments, it’s better late than never. Every moment you lag behind is an opportunity for your competitors to grab your potential customers. So you have to look for all the options to make your store better and more convenient for your customers.

The purpose of this article was to provide you with information about mobile payments for eCommerce. If you find this to be helpful, let us know your feedback in the comments section.