Though a quote and a proforma invoice are the two preliminary documents sent before issuing an invoice, both of them serve two different purposes. When engaging in transactions, whether as a buyer or seller, it is crucial to understand the actual purposes of these two documents.

This blog will shed light on the difference between these two commonly used financial documents. By the end of this read, you’ll have a comprehensive understanding of when, why, and how to use quotes and proforma invoices effectively, ensuring smoother negotiations and transactions.

Let’s get started.

Quotation:

A quote, short for quotation, is a preliminary document provided by a seller to a potential buyer. It serves as an initial estimate of the cost of goods or services and outlines the terms and conditions under which the transaction may take place.

Essentially, a quote is the first step in initiating a discussion between parties, offering a snapshot of pricing, product details, quantities, and any relevant terms. Unlike more formal documents, a quote is often flexible and subject to revision during negotiations.

Proforma Invoices:

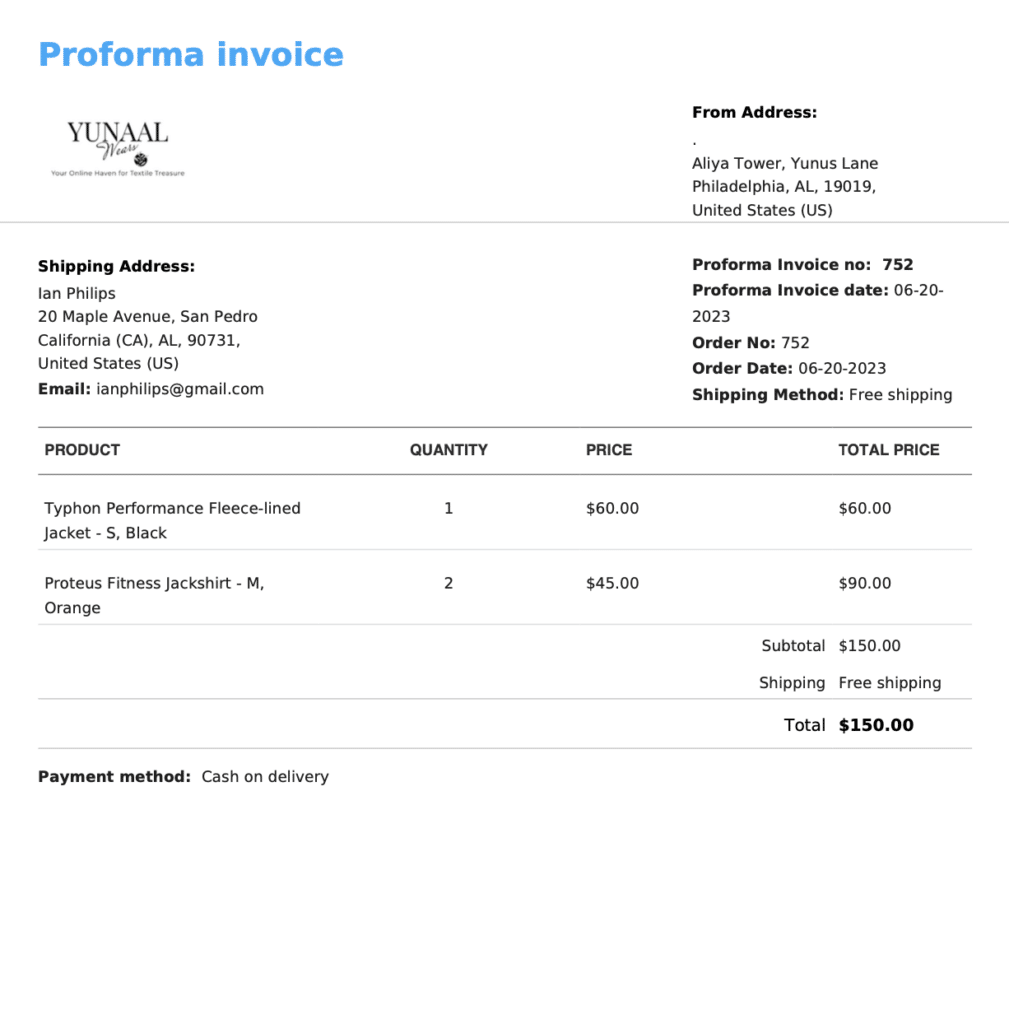

On the other hand, a proforma invoice is a more comprehensive and formalized document than a quote. It functions as a detailed precursor to the actual invoice and provides a comprehensive overview of a potential sale.

A proforma invoice includes not only the cost of goods or services but also outlines the terms of the sale, such as payment details, shipping information, and any applicable taxes or duties. Unlike a quote, a proforma invoice is considered a commitment to sell, offering a more concrete representation of the forthcoming transaction.

A quote should be sent at a strategic point in the sales process, ideally when a potential customer has expressed interest in your product or service.

The primary motivations behind sending a quote are:

Responding to Customer Inquiry:

When a customer expresses interest or makes an inquiry about a product or service, a quote is sent in response to provide the requested information, including pricing and terms.

Cost Estimation:

A quote is sent to provide a clear and detailed estimate of the cost associated with the purchase of goods or services. It helps the potential customer understand the financial aspect of the transaction.

Facilitating Negotiations:

Quotes serve as a starting point for negotiations. They are often flexible, allowing for adjustments to terms and pricing based on further discussions between the buyer and seller.

Decision-Making Support:

For the potential customer, a quote provides essential information for decision-making. It allows them to assess the affordability and value of the offering before committing to a purchase.

A proforma invoice should be issued once both parties have reached an agreement on the prices and terms of a transaction. It is commonly sent after negotiations are complete, serving as confirmation that there are no outstanding questions regarding the pricing and conditions of the deal. However, it’s important to note that the final details should be confirmed with a valid invoice, which serves as the official document for accounting and payment purposes.

Here are some of the primary purposes of a proforma invoice:

Terms of Sale:

It outlines the terms and conditions of the sale, including payment terms, delivery terms, and any other relevant information. This helps in avoiding misunderstandings between the buyer and the seller.

Confirmation of Order:

It serves as a confirmation of the buyer’s order and the seller’s commitment to delivering the goods or services as per the agreed-upon terms. This can be useful in establishing a formal agreement between the parties involved.

Funding or Financing:

Some buyers may use a proforma invoice when seeking financing or funding for a purchase. It can be presented to banks or financial institutions as proof of a pending transaction.

Record Keeping:

Both buyers and sellers use proforma invoices for record-keeping purposes. It helps in maintaining a systematic record of potential sales, including the details of the products or services, prices, and other terms.

In a manufacturing and wholesale trade

Quote Usage: A manufacturer receives an inquiry from a wholesale distributor for a bulk order of a specific product. The manufacturer provides a detailed quote outlining the unit prices, bulk discounts, and shipping terms.

Proforma Invoice Usage: Once the distributor agrees to the terms in the quote, the manufacturer issues a proforma invoice with comprehensive details, including product specifications, shipping costs, and payment terms. This can be used by the distributor to calculate the estimated cost and raise funds accordingly.

In a service-based business

Quote Usage: A consulting firm is approached by a potential client for a project. The firm provides a detailed quote to the client, specifying the scope of work, hourly rates, and any additional expenses.

Proforma Invoice Usage: Once the client approves the quote, the consulting firm issues a proforma invoice, detailing the agreed-upon services, the total project cost, and payment terms.

In retail Sales

Quote Usage: A customer shows an interest in a large order of customized products from a retailer. The retailer provides a quote with the prices for each item, any applicable discounts, and estimated delivery costs.

Proforma Invoice Usage: Upon the customer’s acceptance of the quote, the retailer issues a proforma invoice with detailed descriptions of the products, total costs, and any customization charges.

Conclusion

Quotes, with their flexibility and openness to negotiation, act as a friendly introduction to potential collaborations. On the other hand, proforma invoices, with their detailed formalization, serve as a trusted companion to seal the deal and navigate the complexities. Knowing when to send each document empowers businesses to communicate effectively, establish mutual understanding, and, ultimately, lay the foundation for successful transactions.