- Are your product prices listed exclusive of tax?

- Do you exclusively sell single-purpose gift cards?

With the new VAT regulations in the EU, store owners must pay tax when selling gift card vouchers through their WooCommerce store. However, there’s a problem: if your store calculates tax before applying gift card discounts, it could lead to customers being charged tax twice on the same transaction.

Example:

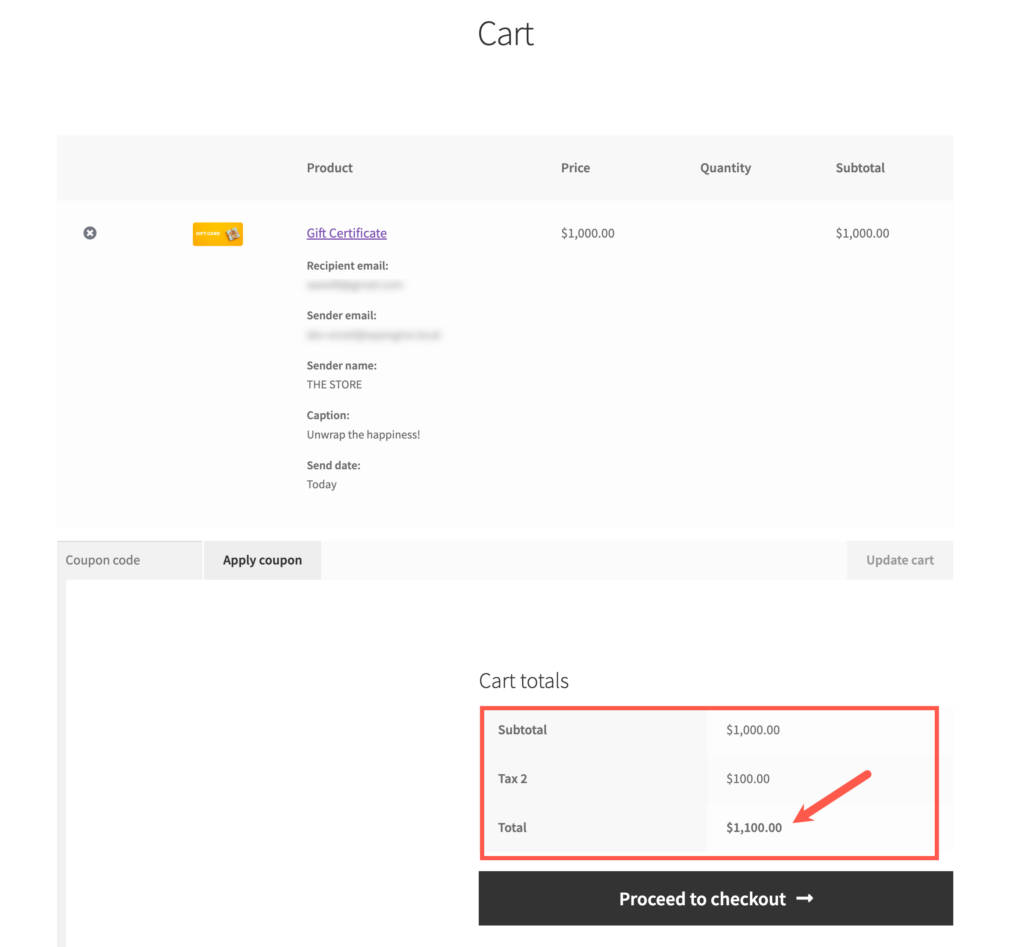

- Let’s say a customer purchases a $1000 gift card and pays a total of $1100 with a 10% tax included.

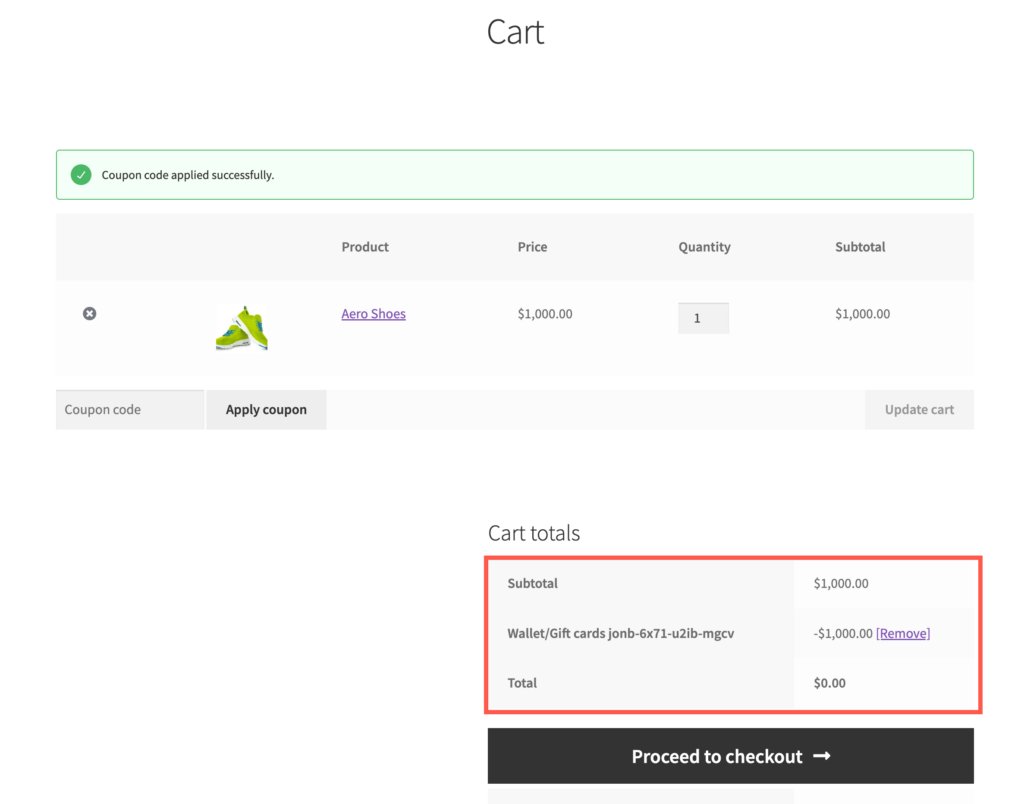

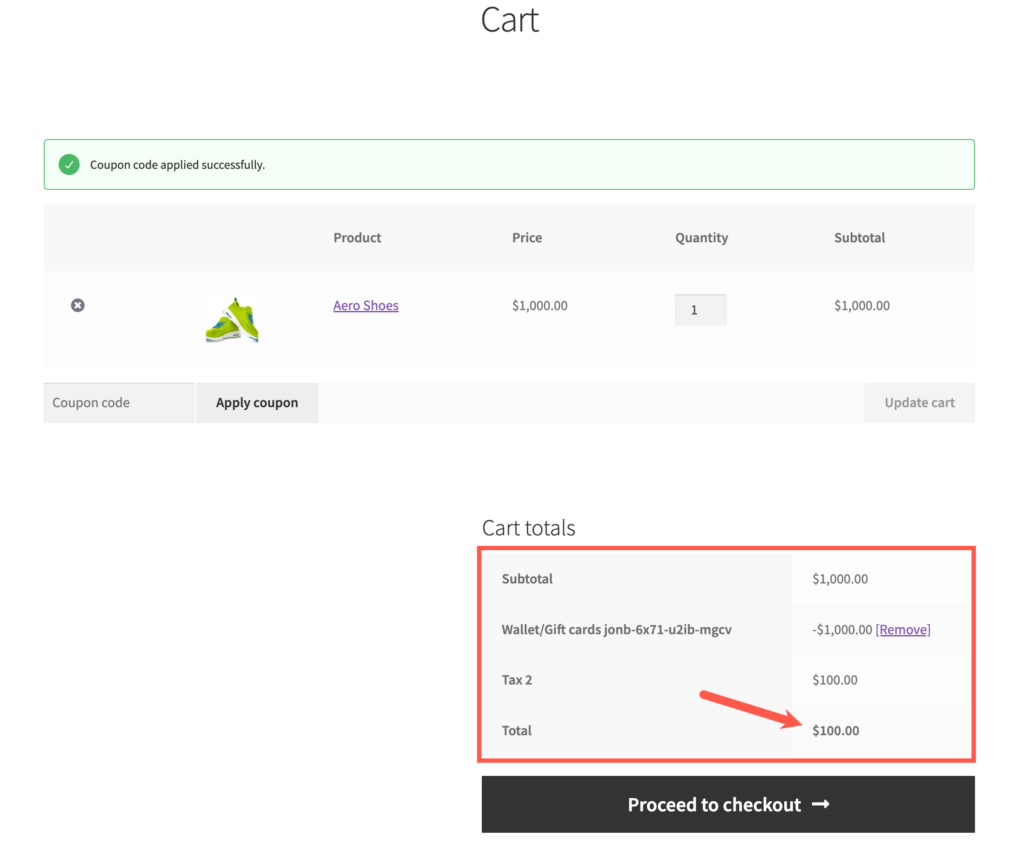

- Later, they come back to the store and use the gift card to buy a $1000 item.

- However, since the store calculates tax before applying the gift card discount, the total payable amount remains $1100 with 10% VAT applied. Even after using the gift card, the customer still has to pay an additional $10.

- This means the customer is essentially charged tax again on the full $1000, resulting in paying tax twice for the same purchase.

Solution

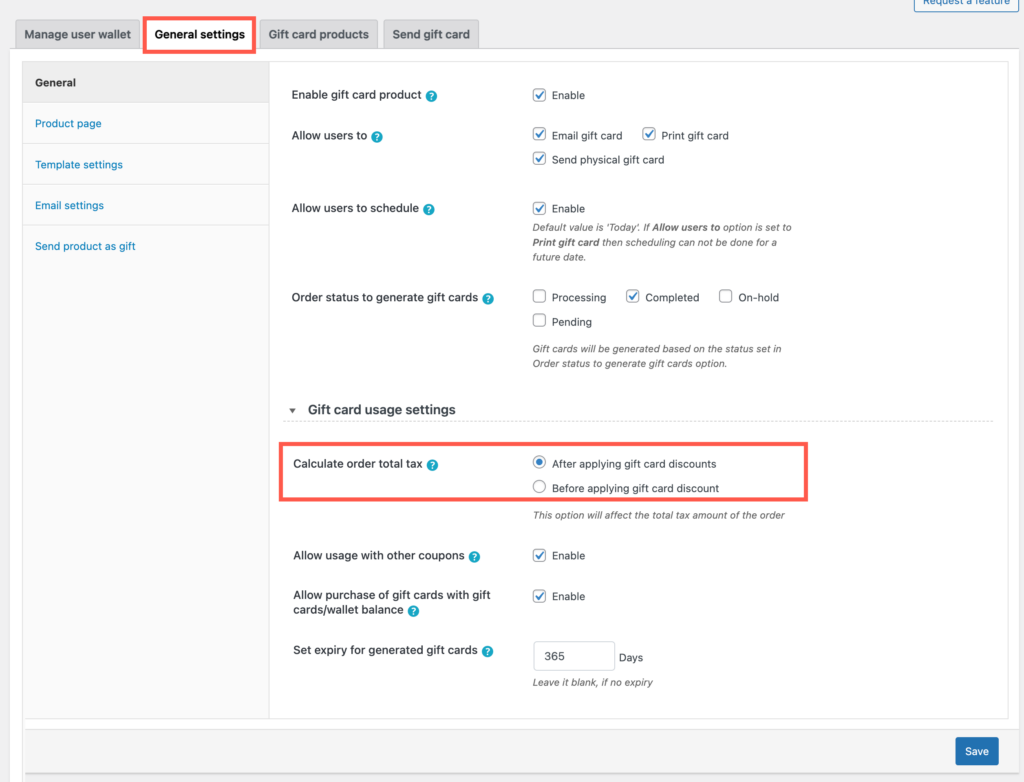

To fix this issue, especially if you use the Gift Cards for WooCommerce plugin, you can adjust the plugin settings so that tax is calculated after applying the gift card discount. Here’s how:

Once you have the plugin installed and your gift card is all set up:

- Install the Gift Cards for WooCommerce plugin and set up your gift cards.

- From the dashboard, go to Gift Cards > General settings > General.

- Scroll down to Gift card usage settings.

- Choose After applying gift card discounts under Calculate order total tax.

- Save your changes.

Now, when customers redeem their gift cards, the discount will be deducted from the subtotal before tax is calculated. This ensures they don’t end up paying tax twice for the same purchase.